Remove the Stress of Managing Your Wealth.

Work with a Chartered Financial Analyst (CFA) to improve your finances.

- Are you confident in your financial decisions?

- Do you have a clear picture of your finances?

- Is your investment portfolio being managed well?

- Are you saving enough relative to your needs and goals?

- Are you benefiting fully from tax-deferred accounts?

- Could you be paying lower taxes?

We’ll focus on your finances while you focus on your life.

Hire a Specialist. Focus on Your Specialty.

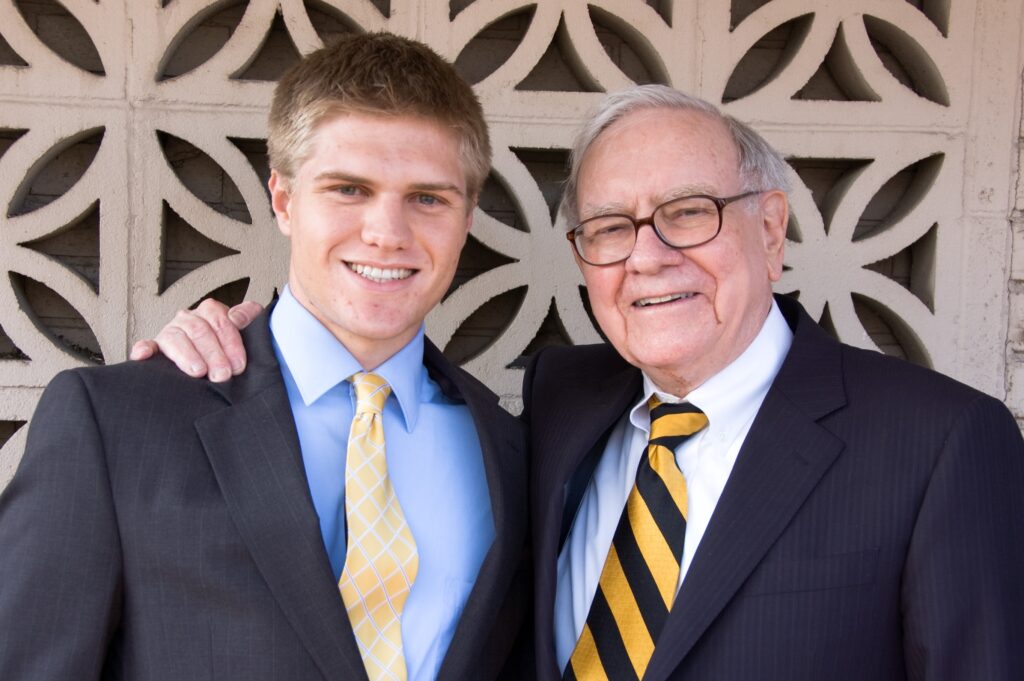

Maple Street is led by David Meehan, an experienced financial advisor in Chicago with over fifteen years of wealth management experience including:

- Working as an international investment analyst on a team managing over $50 billion.

- Interviewing the management teams of over 150 corporations to assess their business.

- Working directly with individuals to reduce taxes and build wealth using sophisticated investment principles.

- Earned the right to use the Chartered Financial Analyst (CFA) designation, the professional standard of choice among investment firms worldwide.

- Graduated cum laude with a degree in Finance from the University of Missouri – Columbia

David Meehan, Founder/Chief Investment Officer

My Latest Insights

Fall 2023 Client Update

When you see Compagnie de L’Odet on your statement, think “UMG at a discount.” And when you think of UMG, think “A royalty on global music consumption.” When people listen to a song, the artists and UMG are…

Spring 2023 Client Update

Berkshire Hathaway Revisited. Berkshire Hathaway remains our largest individual holding (10-15%) outside of index funds in the Capital Appreciation and Outright Capital Appreciation portfolios and I’d like to provide an overview of the company so you can understand…

2022 Client Letter

The “Outright Capital Appreciation”, “Capital Appreciation”, and “Moderate Capital Appreciation” portfolios averaged -7.8%, -1.8%, and -5.0%. I expect our relative returns to do well in a down year for the indexes and lag in an up year for…

Summer 2022 Client Update

Here’s some more detail on the down market that you’ve probably been hearing about. Through June 30, 2022, the total returns of large cap equity indexes in the U.S., Europe, and emerging markets were down -19.9%[1], -18.9%[2], and…