Summer 2022 Client Update

Dear Clients and Friends,

I hope this letter finds you healthy and enjoying your summer.

Prices Down, Return Expectations Up

Prices of equities are down this year, and that’s good for investors buying businesses today for long-term wealth creation.

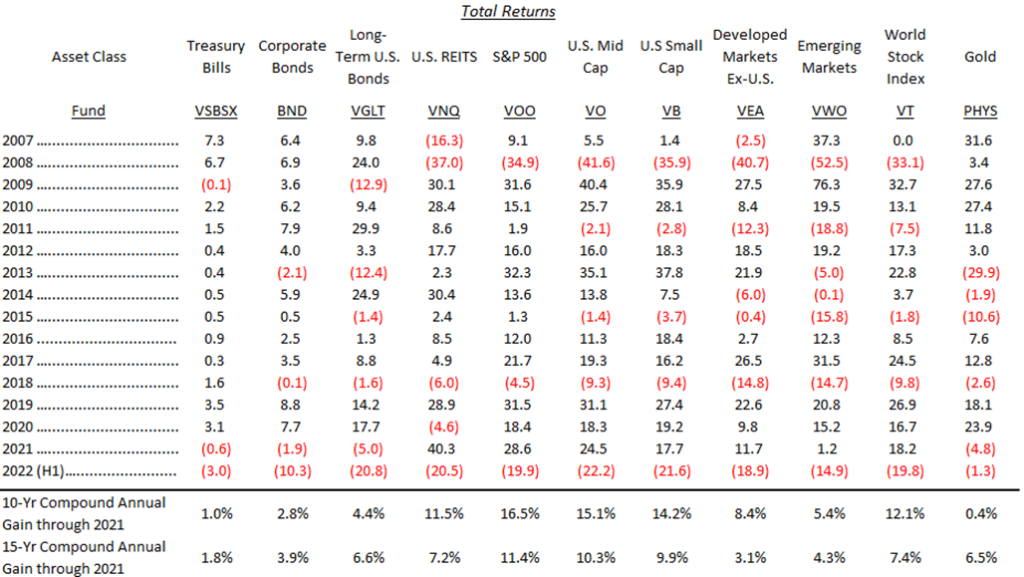

Here’s some more detail on the down market that you’ve probably been hearing about. Through June 30, 2022, the total returns of large cap equity indexes in the U.S., Europe, and emerging markets were down -19.9%[1], -18.9%[2], and -14.9%[3], respectively. Bond returns were negative -10.3%[4]. The total return of the “Capital Appreciation” and “Outright Capital Appreciation” portfolios were down -9-12% and -18-19%, net.

The chart below shows the total return (including interest and dividends) for the major asset classes year-to-date and in previous years.

[1] As measured by VOO, the S&P 500 ETF

[2] As measured by VEA, the Vanguard FTSE Developed Markets ETF

[3] As measured by VWO, the Vanguard FTSE Emerging Markets ETF

[4] As measured by BND, the Vanguard Total Bond ETF

What’s all this mean? Down years are old as dirt. The chart above goes back only to 2007, but down years for the S&P 500 occurred in 2008, 2018, and YTD. Previous down years in the past five decades occurred in 1973, 1974, 1977, 1981, 1990, 2000, 2001, and 2002.

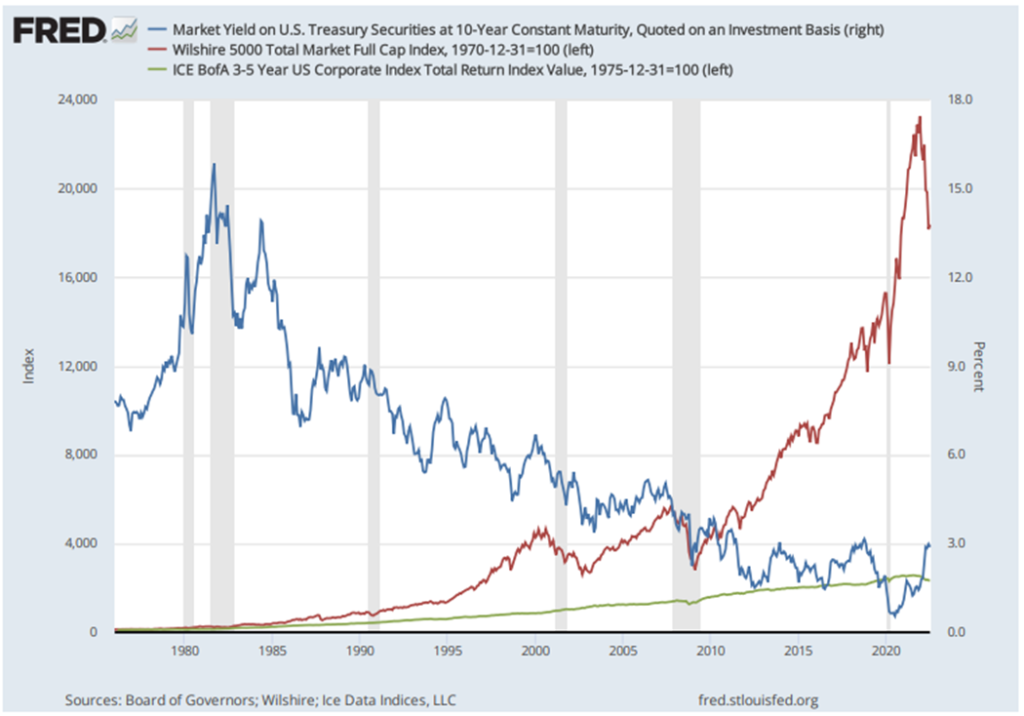

The chart below provides a better visual of the overall trend since 1975, the longest data series comparing stock and bond returns from the St. Louis Federal Reserve.

The fundamental takeaway is that investments in the equity of businesses (stocks) outperform bonds (loans) over long periods of time, but the prices of stocks fluctuate more.

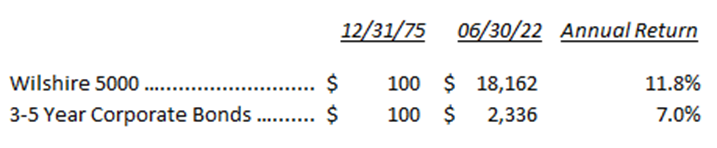

From December 31st, 1975, $100 in a tax-deferred account (IRA or 401(K)) invested in the Wilshire 5000 with all dividends reinvested would have resulted in $18,162 dollars by June 30th, 2022, for an 11.8% compound annual return. Bonds didn’t fare quite as well. One hundred dollars invested in investment grade corporate bonds with a 3–5-year maturity and with all interest payments reinvested would have resulted in $2,336 for a 7.0% compound annual return.

My second takeaway is that future returns for stocks and bonds will be positive but will likely be lower than they were in the past because interest rates are lower. The chart shows the 10-year U.S. Treasury Yield declining throughout the 1980’s, 1990’s, and 2000’s. The market prices financial assets to generate returns exceeding government bonds (to compensate for higher price fluctuations), but only within reason. If equity prices become too low and future returns too high, they will eventually be bid up to reflect a lower return closer to bond returns. It’s a competitive world. However, I do expect equities to outperform bonds by a similar amount, approximately 4%, which is a big deal when compounded over decades.

And here’s what you might not have heard: the current market does not discourage me. In fact, when I look within the indexes at our individual companies, I’m encouraged by their attractive valuations.

Simple Math

With prices down, we can now purchase a larger percentage of businesses for the same amount of cash invested. A $1,000 purchase of a stock at $100/share will purchase 10 shares, but 12.5 shares at $80/share. The result is owning 25% more shares (and 25% more of the business) when the price paid is 20% lower. For investors with long-term horizons and who invest in indexes or high-quality businesses with durable and growing values, lower prices mean future returns will be higher than they were previously.

Of course, the inverse is also true. Lower prices are bad for sellers, which is why maintaining a sufficient emergency fund is crucial for long-term wealth creation. We want to avoid being forced sellers when (and not if) prices temporarily decline.

A Thought Exercise

If a farmer was continually buying acres to add to his farm every year, should he be disappointed if prices for additional land went down? Furthermore, if farms were publicly traded every day and were quoted every second, should he judge the value of his farm based on the latest quote? Is a farm worth less during a drought year when crop yields decline?

I hope the point is clear. Lower prices of quality assets are good for buyers. If you have excess cash, I suggest acquiring more acres (shares) at lower prices for your farm (future wealth). If not, you’ve got your emergency fund — sit tight and wait for the rain to come.

Operations

Maple Street switched compliance support vendors in July. RIAinaBox helped me launch Maple Street Capital Advisors, LLC four years ago and their software and support has helped Maple Street maintain regulatory compliance ever since. I’ve been looking for a dedicated compliance professional and I found Samantha Bonamassa at Coast to Coast Compliance. She is an attorney and financial compliance expert and I’m looking forward to working with her.

Thank you for placing me in a position of trust. It is an honor to work with you and manage your savings.

As always, I enjoy hearing from clients, so please feel free to call me anytime with your questions or comments.

With Thanks,

David Meehan, CFA

Founder & Chief Investment Officer