Investment Approach

As one of the leading investment management services in Chicago, we have three overriding beliefs about investing.

1. Own high quality businesses to generate long-term wealth.

We believe owning profitable and durable businesses for many years is the way to building wealth. Bonds have their place to meet short and medium-term needs, but they generally do not build as much wealth in real purchasing power as equities over the long-term.

2. Maintain adequate liquidity to be resilient.

Prices of equities in aggregate increase over many years, but they fluctuate from year to year. If you invest in equities, you can’t need the money for at least 5 years to avoid having to sell if you need cash when prices are temporarily down.

3. Invest for the long-haul.

Stay patient and buy more shares of high quality businesses when they go on sale.

What we do as your investment management company:

- Determine financial objectives based on the client’s current financial situation, liquidity needs, wealth vs needs, time horizon, and preference.

- Align asset classes (mix of equities, bonds, commodities, cash) to financial objectives.

- Diversify investments across industries.

- Complement broad market indexes with the equity securities of profitable, growing, and durable businesses. Time is the friend of these businesses, and we want to participate in their wealth creation.

- Continually assess fair value through ongoing research and incorporate the valuations of investment securities into the investment decision framework.

What we do not do:

- We do not trade between cash and investments based on short-term price expectations.

- We do not borrow money to invest.

- We do not bet against investment securities by borrowing shares and “selling short.”

- We do not overpay for investments.

For a more detailed description, read this excerpt from the Spring 2022 client letter.

How Our Investment Managers Work: Our Methodology from the Top-Down

We thought it would be helpful to provide a quick refresher of how we invest, so you can better understand what you own and why.

First, we designate savings as short-term or long-term. (For clients within 10-years of retirement, we incorporate an intermediate term.) What does this mean in practice? Clients keep enough cash in their checking account for 1-2 months of living expenses and an emergency fund in a separate savings or money market account. The number of months of living expenses in their emergency fund depends on the stability of the client’s income(s) and personal preference.

Cash designated as “short-term money,” is a form of insurance for potential needs. Once those needs are met, remaining cash can be designated as “long-term money” and allocated first in retirement accounts to reduce taxes. At that point, cash becomes speculative because the expected return in purchasing power is negative. In an environment like today where cash earns <1% and inflation is 7%+, cash will almost surely purchase significantly less in the future.

Historically, a stock/bond split for a portfolio with a multi-decade time horizon would be between 60/40 and 90/10. Bonds would reduce the price fluctuations of the portfolio and pay interest at or above the level of inflation. Stocks would earn their risk premium over long periods of time (10+ years) and returns would exceed inflation and generate wealth in purchasing power. Today, with bonds earning significantly less than inflation, we have replaced some of the bond allocation with a basket of tangible asset exposures to gold, silver, copper, oil & gas, and real estate.

For clients with multi-decade time horizons, I believe the largest risk is the persistent increase in prices of everyday goods and services (healthcare, living expenses, etc.) We address the risk of higher prices by investing in the equity securities of profitable and durable businesses that can also increase prices for their goods and services.

Maple Street Model Portfolios

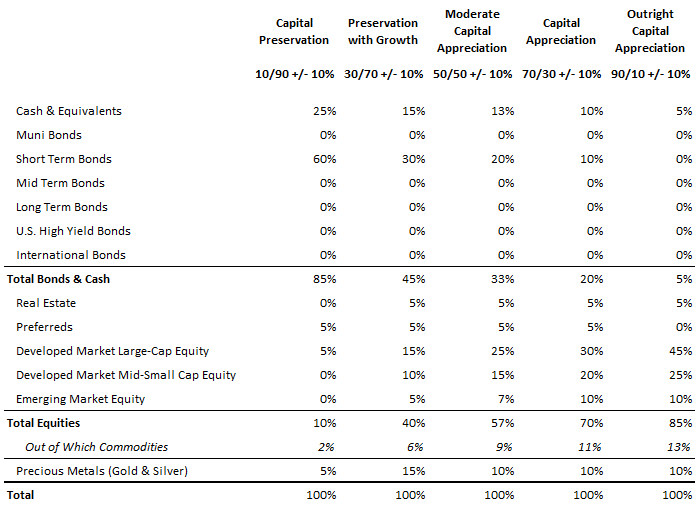

The chart below shows the Maple Street Model Portfolios. After working through each client’s financial situation, we determine the best allocation for the client at that time. Portfolios look static in the chart, but they can fluctuate +/-10% for each asset class from returns or rebalancing based on relative valuation.

Most clients will have at least two or three account-types, such as a solo 401(k), SEP IRA, Traditional IRA, Roth IRA, and a brokerage. The model portfolio is what we target on the clients consolidated picture. A particular account may look different for tax reasons.

Our Methodology from the Bottom-Up

Bottom-up refers to the actual businesses and the investment securities owned. Portfolios are constructed from the bottom-up, but with checks and balances from the top-down to manage risk.

Broad-based indexes are complemented with sector ETFs (currently Vanguard Energy, ticker VDE) and individual companies not in the index or with a weighting smaller than we would like based on the valuation of the security and future prospects relative to the indexes. Some businesses are not eligible for the indexes and this can present opportunities. Publicly traded partnerships (BSM), trusts (TPL last year), holding companies (Exor, Odet), limited share availability (UHAL, Odet), and newly public companies from spin-offs (not-disclosed).

The Vanguard Energy ETF (VDE) was one such holding where the weighting was smaller than we viewed optimal. Energy is a component of the S&P 500, but after a decade of huge returns by technology companies (Microsoft, Google, Facebook, Apple, etc.), energy was down to a 3% weighting. We added 4-6% positions in VDE on top of 3-4% positions in Texas Pacific Land Trust to bring the energy weighting over 10% when including the energy components in the S&P 500 and Berkshire Hathaway. We first purchased VDE in spring 2020 when oil prices declined below zero as the global economy shut-down. We took a shot-gun approach and bought the fund as well as Texas Pacific Land Trust not included in the fund. Prices for energy companies declined significantly to a level where it was obvious the survivors would do very well, but if prices didn’t recover quickly, there would also be shareholder dilution and bankruptcies. We chose to invest in the largest companies through VDE (Exxon, Chevron, Conoco, etc.) because we thought the probability of positive returns was highest and the probability of significant losses lowest. In spring 2021, we swapped TPL for Black Stone Minerals (BSM) based on valuation. The energy weighting is now in the 15% range because of growth.

We previously mentioned the replacement of bonds for tangible assets. We have done this in several ways. We have invested in gold and silver held in vaults in North America. We have invested in the equity of an asset manager of gold, silver, platinum, palladium, and uranium. And we have invested in a precious metal royalty company that benefits from higher volumes and prices while avoiding operational risks. This year, we invested in a royalty company that owns royalties on copper mines, low-cost potash mines, high-purity iron ore, battery metals, and wind & solar assets.

Berkshire Hathaway remains our largest position at ~10-15% of equity portfolios. The position is large because it is highly diversified and consistently profitable, with a very conservative balance sheet and management is uniquely aligned with shareholders. Its largest business is insurance (GEICO) followed by its position in Apple (17% of value), BNSF railroad (13% of value), a catch-all segment called “Manufacturing, Services & Retail” (23%), and Berkshire Hathaway Energy (10%). Other companies will grow faster, but my conviction is that Berkshire Hathaway will continue to chug along and earn a very satisfactory return for shareholders over the next 10 years. It provides a resilience to portfolios and we believe there is a very good chance its return will exceed that of the S&P 500 over the next 10 years.

Speaking of energy, Berkshire Hathaway is one of the largest renewable energy companies in the United States. It has invested $35.5 billion to date in wind, solar, and geothermal assets and has plans to spend an additional $4.9 billion in 2022. It earned $4.7 billion after-tax in 2021 on equity of $40 billion and it reinvests all profits in new projects at adequate returns (8-12%).