Insights

-

Fall 2023 Client Update

When you see Compagnie de L’Odet on your statement, think “UMG at a discount.” And when you think of UMG, think “A royalty on global music consumption.” When people listen to a song, the artists and UMG are paid. It is an incredibly resilient and profitable business with a nice growth tailwind because of global…

-

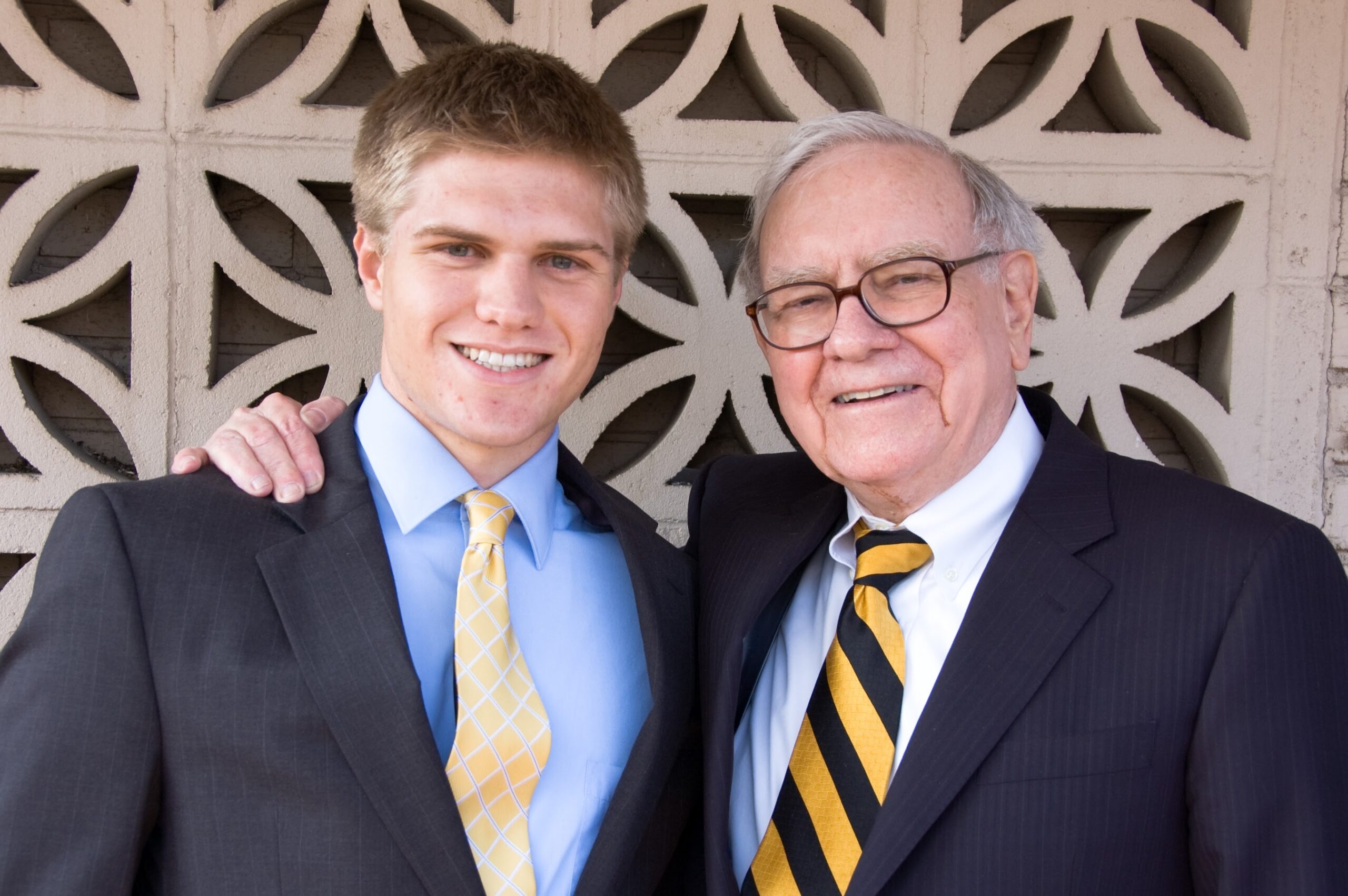

Spring 2023 Client Update

Berkshire Hathaway Revisited. Berkshire Hathaway remains our largest individual holding (10-15%) outside of index funds in the Capital Appreciation and Outright Capital Appreciation portfolios and I’d like to provide an overview of the company so you can understand why we own it in size. If you prefer the one-minute version, read the “reasons to own”…

-

2022 Client Letter

The “Outright Capital Appreciation”, “Capital Appreciation”, and “Moderate Capital Appreciation” portfolios averaged -7.8%, -1.8%, and -5.0%. I expect our relative returns to do well in a down year for the indexes and lag in an up year for the indexes, but I’m still pleased by the amount of our relative outperformance.