Fall 2023 Client Update

Dear Clients and Friends,

The S&P 500 was up 13% year-to-date through the third quarter. International stocks (VEA) were up 6.2% and the U.S. corporate bond index (BND) was down -0.88% on a total return basis.

The “Outright Capital Appreciation”, “Capital Appreciation”, and “Moderate Capital Appreciation” portfolios averaged 9.6%, 6.7%, and 4.5%.

Notables include Berkshire Hathaway 13.4%, Black Stone Minerals 10.4%, Vanguard Energy ETF 7.1%, KKR 33%, and Apollo Global 43%. Small-Cap (VB) and Mid-cap (VO) equities were up 4.2% and 3.3%. Gold was up 2.5%.

Prices of equities in October are down across the board as long-term interest rates have continued to increase. Mortgage rates recently hit 7.9%. As explained below, we have the liquidity to buy great companies at bargain prices if they become available.

Short Term Bonds Are Finally Worth Owning

United States treasury bonds are backed by the full faith and credit (and taxing authority) of the federal government. As such, they are deemed to have the lowest credit risk of any financial asset. We can buy treasury bonds with maturities ranging from 1 day to 30 years.

Until early 2022, short-term rates were below 1% for most of the past 15 years. With their rapid rise above 5%, we added 5-15% positions in the two-year U.S. Treasury bond in equity portfolios and 30-35% positions in the moderate capital appreciation portfolios in the past few months with proceeds from deposits, the sale of U-Haul, and the INFL ETF in some cases. The primary motivation is to serve as a source of cash to purchase businesses at low prices while also earning a decent 5.1% return with almost no principal risk.

Portfolio Changes: We Bought A Lot More Compagnie de L’Odet

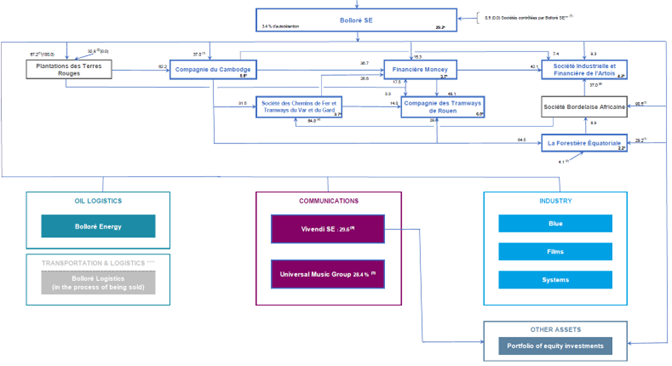

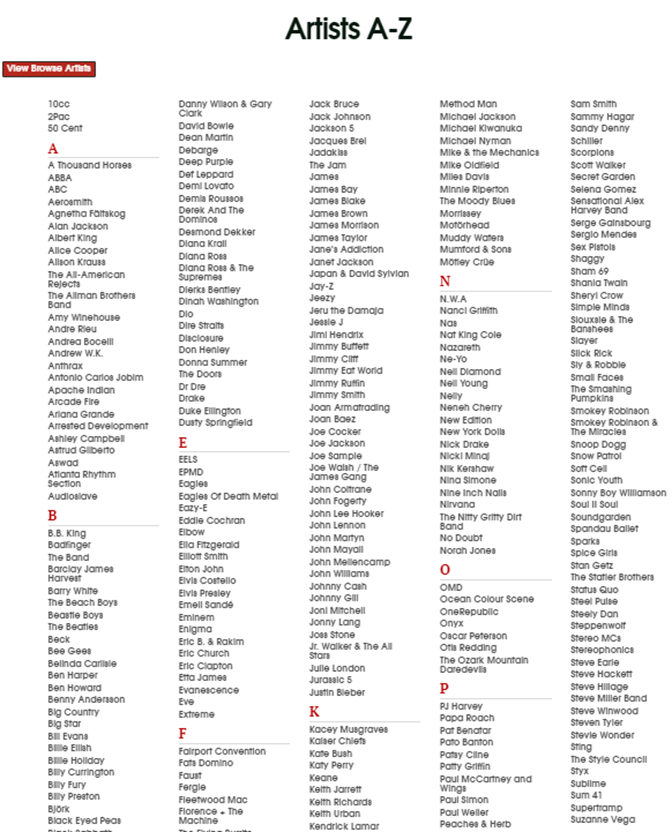

We significantly increased our position in Odet, a holding company controlled by the Bollore family in France. Odet’s primary asset is a 70.8% ownership interest in Bollore SE. The crown jewel of Bollore SE is an 18.1% position in Universal Music Group (UMG), the largest music company in the world, representing music artists from Taylor Swift to James Taylor. Bollore also owns a 29.9% interest in Vivendi, itself a French holding company of European media assets, including a 9.98% interest in UMG. Bollore has E1.4 billion in net cash on its balance sheet and is under contract to sell its logistics business for E4.65 billion euros, which will increase net cash to ~E6.0 billion in the first quarter of 2024.

When you see Compagnie de L’Odet on your statement, think “UMG at a discount.” And when you think of UMG, think “A royalty on global music consumption.” When people listen to a song, the artists and UMG are paid. It is an incredibly resilient and profitable business with a nice growth tailwind because of global smartphone proliferation and growth in subscriptions to streaming services such as Spotify, Apple Music, Youtube, Amazon, Pandora, Soundcloud, Tencent, etc. that offer unlimited listening of almost every song ever recorded for a modest monthly fee or free with advertisements.

For the highlights only, read the “reasons to own” and “key risks” below and skip to the planning section on page 6.

Reasons to Own:

- Odet trades at 25 cents on a growing dollar.

- Odet offers a dual margin of safety in asset quality and price. Downside is limited because of the stability and growth of UMG, Vivendi, and strong balance sheet at a bargain price.

- UMG is a royalty on global music consumption. It is a highly profitable and resilient business with ~30% market share in a global oligopoly with ~70% market share. It grows revenue at high single digit rates, profits in the low teens, and requires limited capital to grow.

- The Bollore family has significant skin in the game and has been an excellent steward of capital for Odet and Bollore for decades.

- Management has the optionality to repurchase shares and simplify the structure of the organization by merging entities to make the discount undeniable.

Key Risks:

- Capital Allocation: Management of Bollore intends to use proceeds from the sale of Bollore Logistics to acquire a business to operate. Buying businesses does not always go well.

- Take-under: Management could attempt to take Odet and/or Bollore private at a discounted price. In this scenario, we would make money because the takeover price would need to be much higher, but it could prevent us from realizing intrinsic value. We are riding on the coattails of institutional investors to maintain a 10% position to block a take-under and protect our rights as minority shareholders.

- The economic split of intellectual property rights between artists, record labels, and publishers could favor artists over time. This is a slow moving and long-term risk.

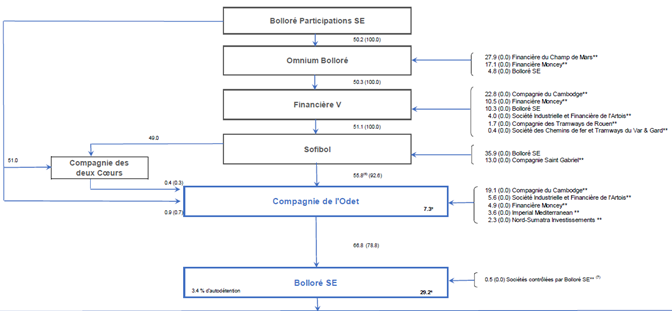

The Bollore Family

Vincent Bollore (age 72) bought back his families’ struggling paper manufacturing business in 1983 for 1 franc. He turned it around and IPO’d it four years later. Over the next three and a half decades, he expanded the business into logistics, freight forwarding, oil pipelines, corporate raider investments, telecom, and eventually advertising, publishing, and media. The stock increased 100x. He is currently Chairman of the Board of Odet and three of his five children have leadership positions at Odet, Bollore, and Vivendi. (I know, nepotism. However, they all appear to be very capable people).

I’d describe the ethos of the family as adaptive and disciplined, but not cold. Vincent wants his children to pursue profitable businesses they are passionate about, which may be one reason why they are exiting the profitable logistics businesses.

Universal Music Group

UMG is the largest music company in the world, owning over 3 million songs and 4 million titles. UMG provides all the behind-the-scenes management and administration that musicians are not equipped to do for themselves. One of the companies’ tag lines is “turning hit songs into careers.” They fund emerging artists to record music and help them break through by marketing and promoting them across global markets, working with a huge array of stakeholders, from live event companies, to sponsors, media, film, television, social media, videogames, and crucially, the streaming platforms. UMG’s market share of music consumption on streaming platforms is 30% and it uses this share to negotiate valuable space for its songs and titles. For example, there are an estimated 100,000 songs uploaded to streaming platforms PER DAY because it’s free and anyone can upload a song. UMG helps artists cut through the noise to reach the top and when artists do reach the top, they help them maintain their presence against the onslaught of musicians also competing to be heard.

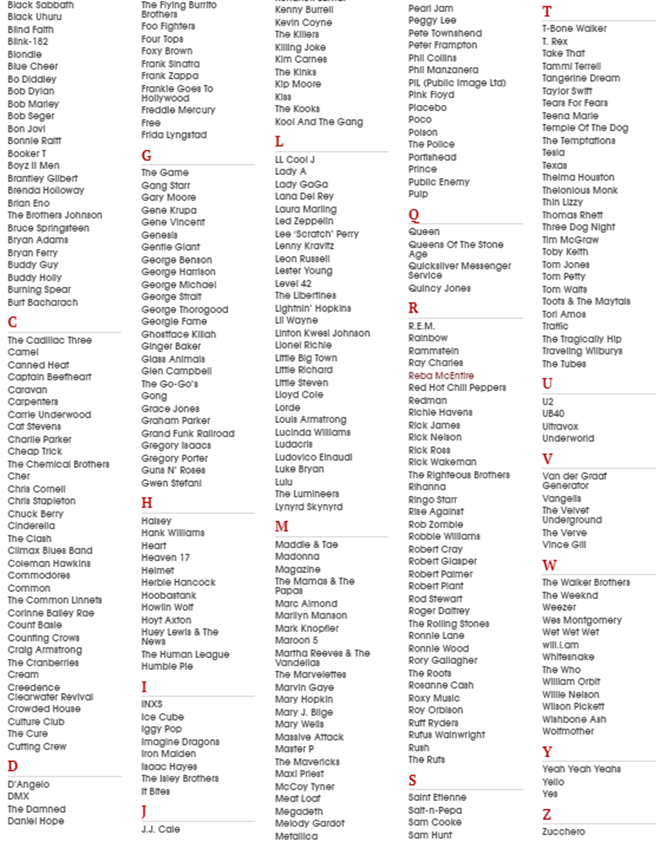

Artists benefit by working with UMG. It’s better for artists to earn 45% of royalty revenues generated with the support of UMG and to develop a brand they can monetize through concerts and other licensing agreements than to have 100% of the tips from performing at a restaurant or club. It’s not even close, and that’s why Taylor Swift, John Legend, Justin Bieber, Mumford & Sons, Katie Perry, Jay-Z, Drake, and 600 other artists signed with UMG. (See the appendix for a list of UMG artists.)

The economics of UMG are excellent. It is the leader in an oligopoly with Sony Music and Warner Music Group that combine to have a 70% share. In the music industry, the IP is split between the song (recording) and the lyrics and written music (publishing). UMG owns the IP it acquires or develops and benefits from its position between fragmented suppliers (artists) and distributors (streaming platforms) that need UMG’s catalogue of songs. The IP has a long lifespan because people continue to listen to the same music they did in their teens and twenties for the rest of their lives. (Anecdotally, my dad still listens to John Denver and Willie Nelson, and my wife’s playlists runs from Dave Brubeck to Barry White.) And with the proliferation and modest cost of streaming platforms, listening hours and paid subscribers are increasing globally. Streaming will grow for a long time as it takes market share from radio and more people become paid subscribers to avoid commercials and listen to their playlists on demand.

Vivendi

Bollore SE owns 29.9% of Vivendi, itself a holding company consisting of an assortment of media assets including advertising (Havas), pay tv (Canal+), publishing (Hatchette), Travel Retail (Lagardere), Telecom (Telecom Italia), and a 9.98% ownership stake in UMG worth about E4.5 billion. The market cap of Vivendi is about E8 billion and is trading at about ½ of intrinsic value on a sum-of-the-parts basis. I think Vivendi is trading at a huge discount for a reason. If management can exit underperforming businesses like Telecom Italia and narrow its focus, there is the opportunity for faster growth and a narrowing of the discount.

Organizational Structure

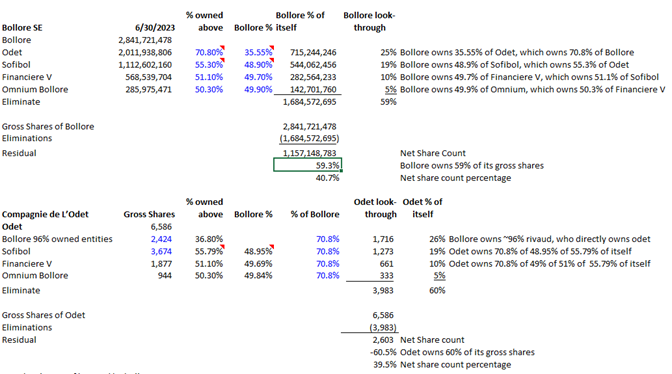

The organization operates under a circular ownership structure designed in the 1980s to maximize leverage and equity growth while maintaining voting control. The circular ownership structure consists of seven levels with the family controlling the entity at the top (see appendix). Bollore currently owns 59% of its gross shares by owning interests in entities that own entities that own Bollore.

Here is an analogy to the structure. Assume that you are Bollore SE and you own 96% of your children. Your children own 35% of your parents, who own 70.8% of you. Furthermore, your children also own 48% of your grandparents who own 55% of your parents, who own 70.8% of you. Now, exchange your family for business entities that can be legally merged. Upon merger, the shares that you own of yourself cancel out.

The family has merged or “squeezed-out” entities in the past and it could merge the remaining entities to eliminate the cross-ownership, simplify the structure, and make clear the true net shares outstanding. Just three years ago, Odet owned 64.0% of Bollore, and today it owns 70.8% after purchases from the Odet entity and buybacks from Bollore. As the cross-ownership increases, the remaining benefit of the structure diminishes and the point where it makes sense to simplify the structure or merge generations approaches.

The 533 million shares held by the public, representing 18.8% of gross shares (not including the shares held by Yacktman Funds or a long-time investor (Orfim) would cost just E2.66 billion. Bollore will have E6.0 billion in net cash in the first quarter of next year if the freight forwarding sale closes.

Our history with the stock

We originally purchased shares of Odet in March 2020 at E540/share after it declined at the onset of covid. The thesis was simple. I thought the business was extremely durable, management was capable based on its long track record, and the shares were trading at a large discount. A year later, Vivendi spun off UMG (retaining 10%) and I came to appreciate the quality and growth prospects with the improved financial disclosure. We bought more shares in 2021 and 2022 between $1,050 and $1,365. The intrinsic value per share has continued to increase with the sale of its logistics business in Africa and freight forwarding business for a combined E10.3 billion, growth at UMG, and share repurchases. In May 2023, Bollore tendered for 10% of its gross shares at E5.75/share and 3.33% of shares were tendered. No insiders sold. We bought more shares between $1,300 and $1,524 in the third quarter and October.

How might it play out?

There is a quote by Charlie Munger, “Show me the incentives and I’ll show you the outcome.”

The family has little incentive to collapse the structure and realize the full value of shares while there are shares available for purchase in the open market at discounted prices. They control the business and have little outside shareholder pressure. The only drawback from a discounted price is that it makes acquisitions with shares extremely expensive and therefore effectively limits the size of businesses Bollore SE can buy to the cash and borrowing ability of its balance sheet.

In the most likely scenario, I think Bollore will acquire a controlling stake in another business and then repurchase shares with any excess funds available, staying patient for weaker hands to sell. Only when trading volume approaches zero and tender offers no longer achieve results at prices they are willing to pay will the family make the next best decision and simplify the structure. It could easily take another five or ten years for the simplification to play out, which is why the growth of UMG is so important. We don’t need the discount to improve to do well.

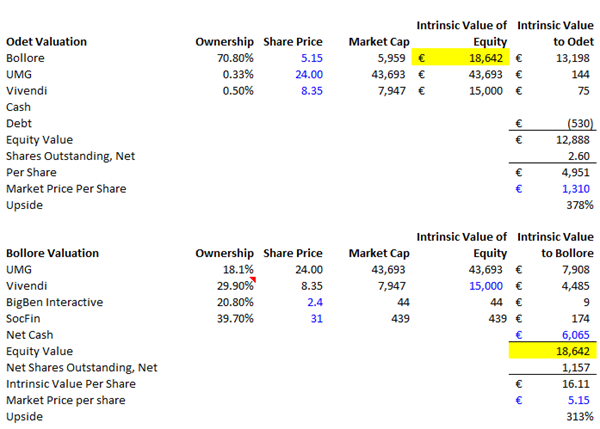

Valuation

The market cap of Bollore using net shares after eliminating crossholdings is only E5.8 billion as compared to my estimate of intrinsic value of E18.6 billion. The situation is ripe with optionality for the family to continue to repurchase shares and simplify the structure to eventually realize intrinsic value. The E18.6 billion intrinsic value of Bollore implies E4,950/share for Odet, not assuming further share repurchases. At the current discount to intrinsic value, repurchases are very powerful. A 1% repurchase of gross shares reduces net shares by 2.5% and increases intrinsic value per share by 1.7%.

Odet trades at 25 cents on a growing dollar and offers tremendous potential for upside if management repurchases shares and begins to simplify the structure to make clear the net shares outstanding and undeniable value. I’m excited to see what management will do next.

We Sold U-Haul

We sold U-Haul, previously called Amerco Corporation. We first bought it in 2018 between $32-$35/share on a split-adjusted basis and sold it between $53 and $58 for a ~10% IRR. It was a profitable investment, but it basically matched the return of the S&P 500. I still think the company has a formidable moat and the operations are managed well, but I don’t like that they are reinvesting all profits into building more storage units at lower and lower returns despite declining industry fundamentals for moving and storage. U-Haul’s profits are highly correlated with truck rentals, moves, and mortgage rates. All of these factors are working against U-Haul for the foreseeable future, which is not good for a company with significant operating leverage. It’s a business I know well and hope to buy it again at the right price if management changes its capital allocation strategy.

Planning

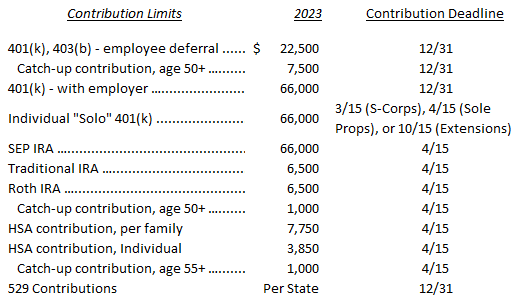

For your reference, I include the 2023 IRS indexed contribution limits and deadlines. Remember, Health Savings Accounts (HSAs) do not have an income limit to make the contribution and receive the deduction. For those of you in the 42% tax bracket (state & federal), a full family contribution will save you $3,062.

Operations

Your portfolio analyst report for the third quarter is uploaded to the shared folder in your vault. This report consolidates your accounts at Interactive Brokers to provide a full picture of your asset allocation, investment holdings, and returns. Your single account statements may not reflect your overall asset allocation because the holdings in your brokerage and retirement accounts may be different for tax purposes.

Thank you for placing me in a position of trust. It is an honor to work with you and manage your savings.

As always, please feel free to reach out anytime with your questions or comments.

With Thanks,

David Meehan, CFA

Founder & Chief Investment Officer

Appendix

Compagnie de L’Odet Valuation Estimate

Odet Ownership Structure

Odet owns 60% of its gross shares.