Spring 2023 Client Update

Dear Clients and Friends,

After price declines in 2022, stock and bond prices have partially rebounded this year through April. In the first quarter, the S&P 500 (VOO) increased 7.5%, international stocks (VEA) increased 7.7%, and the corporate bond index (BND) increased 3.2%. Prices are up marginally in April.

The Wonder of Compounding

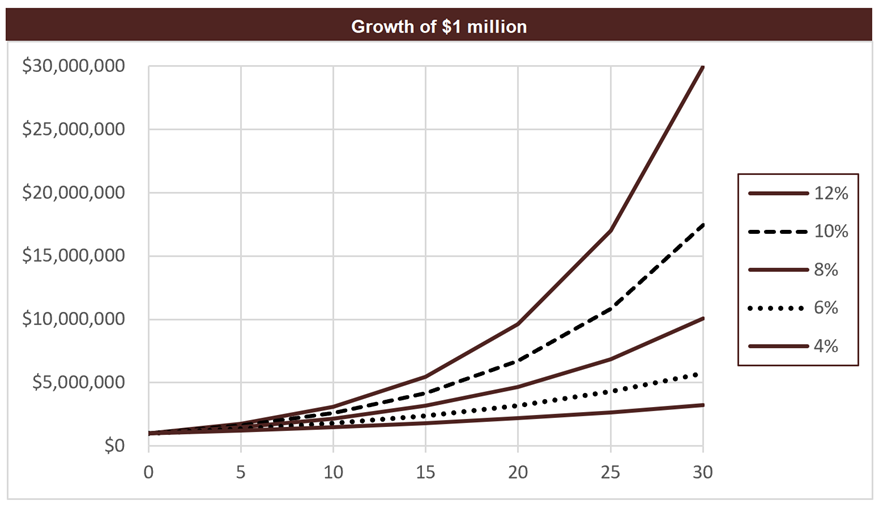

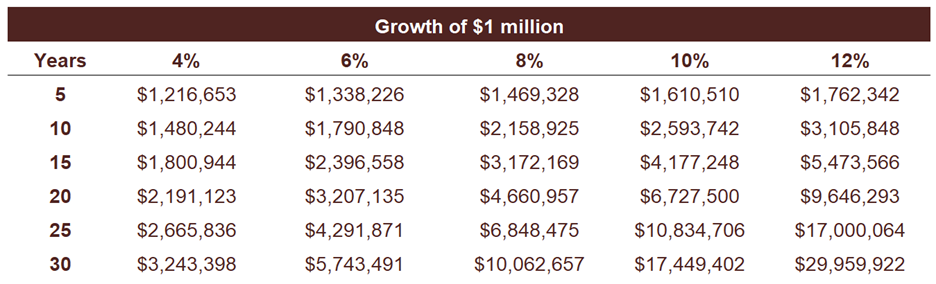

U.S. Treasury Bonds yields have increased to ~4% over the last year from ~2% and while it may be tempting to “lock-in” the return and head to the first tee, I think investing long-term money in high quality companies will be worth the effort.

The chart and graph below show how small differences of 2-4% per year really add up. After 20 years, an additional 4% per year results in 2x as much money, and it increases to 3x after 30 years. That’s a lot of additional dollars! Furthermore, if rates go back down, stocks could increase, and we would be worse off — faced with an unpleasant decision to either keep money invested at 2%-3% or buy stocks at higher prices.

Berkshire Hathaway Revisited

Berkshire Hathaway remains our largest individual holding (10-15%) outside of index funds in the Capital Appreciation and Outright Capital Appreciation portfolios and I’d like to provide an overview of the company so you can understand why we own it in size. If you prefer the one-minute version, read the “reasons to own” below and skip to the planning section on page 11.

Reasons To Own:

- Built to last. A profitable and diversified holding company with durable economic characteristics. Apple is ~15% of value, BNSF ~13%, Energy ~12%, GEICO, Chevron…

- Excellent capital allocation. Management allocates the profits extremely well. I expect earnings per share growth of ~10% for the next decade.

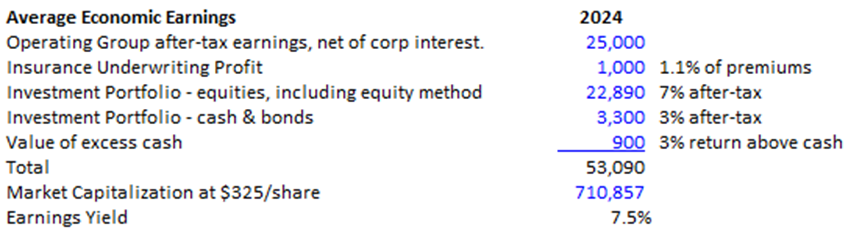

- Attractive valuation. At $325/share, the economic earnings yield is 7.5% (pre-growth) providing an attractive price for share repurchases. Potential for multiple expansion to 16x earnings from 13x could boost the IRR to 12% over the next decade.

- Fortress balance sheet. BRK currently has $110 billion in cash and cash equivalents.

- Shareholder alignment. Management and board members all have significant ownership in BRK shares. There is no stock dilution from compensation plans. Insiders buy shares with their own money and free will.

Key Risks:

- Insurance losses. A rare and extreme insurance loss from a hurricane, earthquake, cyber-attack, EMP event, etc. Berkshire Reinsurance has underwritten policies to limit total pre-tax losses from any single catastrophe to $15 billion pre-tax. They are good for it and say they would continue to write policies the next day (at presumably higher prices.)

- Regulatory changes such as taxing unrealized gains, stock repurchases, or increasing the corporate tax rate.

- Management quality degrades with management turnover.

Overview

Warren Buffett bought control of a dying textile mill in 1965 (Berkshire Hathaway) followed by an insurance company in 1967 and expanded it over six decades to include a wide range of wholly-owned businesses including a railroad (Burling Northern), energy generation and distribution assets, and dozens of manufacturing, service, and retail businesses. In addition, it owns a portfolio of publicly traded stocks worth $325 billion at current prices, including a position in Apple with a market value of $146 billion.

Berkshire operates its wholly-owned businesses on a uniquely decentralized basis. Its main centralized functions are to appoint and compensate the CEOs and allocate excess profits sent to it from its subsidiaries. Other centralized functions include risk management, compliance, and maintaining the culture of integrity.

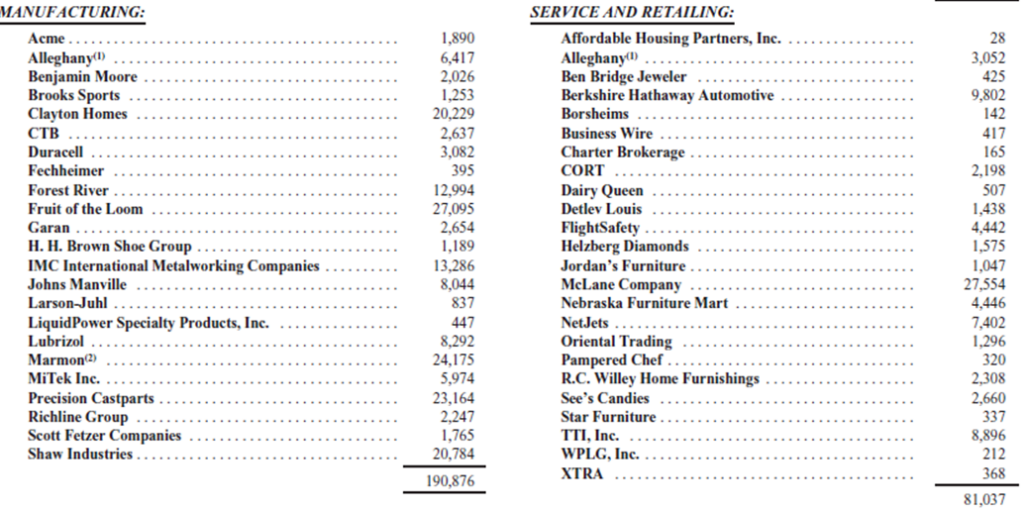

Here are some of the wholly-owned businesses and investment holdings you will undoubtedly recognize.

Insurance – The Foundation (GEICO & many other subsidiary insurance companies)

Berkshire Hathaway’s property/casualty insurance business is the largest in the world. Insurance is a business of receiving money upfront (premiums) and distributing it out later (claims). In between, the insurance company can invest that pool of money, called “the float” for its own benefit. While the money for premiums and claims comes and goes, the float is relatively constant and in Berkshire’s case, usually grows. In effect, Berkshire borrows money at no cost or even negative cost and with no maturity. It usually receives more in premiums than it pays out in claims and operating expenses and earns an underwriting profit. The float at Berkshire was $164 billion at year-end 2022 and it earned an underwriting profit in 18 of the last 20 years, generating a cumulative underwriting profit of $29.5 billion!

From Berkshire’s 2022 Annual Report:

“Our Property/Casualty (“P/C”) insurance business has been the engine propelling Berkshire’s growth since 1967, the year we acquired National Indemnity and its sister company, National Fire & Marine, for $8.6 million. Today, National Indemnity is the largest P/C company in the world as measured by net worth. Insurance is a business of promises, and Berkshire’s ability to honor its commitments is unmatched.”

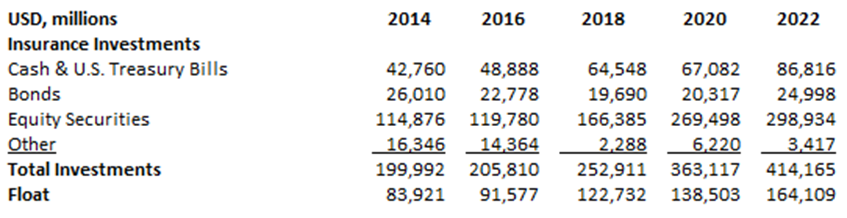

Berkshire ended 2022 with $110 billion in cash and short-term bonds and said it will always keep at least $30 billion in cash and treasury bills to pay claims. The rest can be invested in equities with the objective of earning higher returns over the long term. The chart below shows the Insurance investment portfolio going back to 2014.

The Operating Businesses

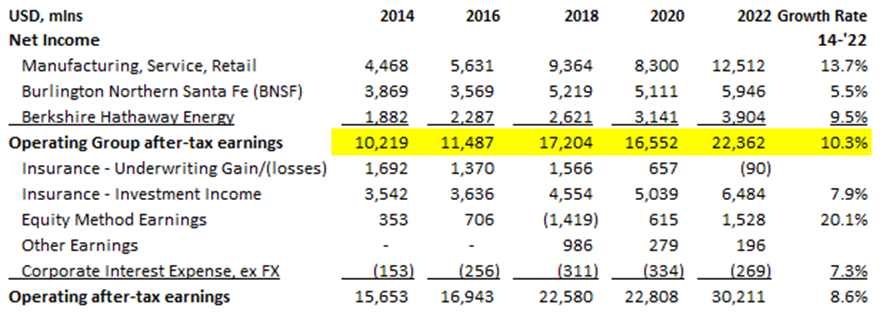

The wholly-owned operating businesses are consistently profitable. The best metric to view profitability is the operating group after-tax earnings because it provides a clearer picture of the underlying profitability by excluding the fluctuating gains/(losses) from the investment portfolio. In 2014, operating group after-tax earnings were ~$10.2 billion and they grew to ~$22.3 billion by 2022, for a growth rate of 10.3%. Cumulative profits between 2014 and 2022 were $140 billion.

Manufacturing, Service, & Retail (MSR)

The MSR segment includes dozens of businesses and serves as a catch-all segment. It collectively earned a ~10% return on equity the last few years and I expect that rate to continue. The underlying profitability of the businesses is ~20% on tangible equity and speaks to their strong economic characteristics. Berkshire paid more than the tangible equity to acquire these businesses as is common, but it still earns a respectable 10% on the money it paid for the businesses with very little leverage.

The chart below lists the companies and the number of employees. How many do you recognize?

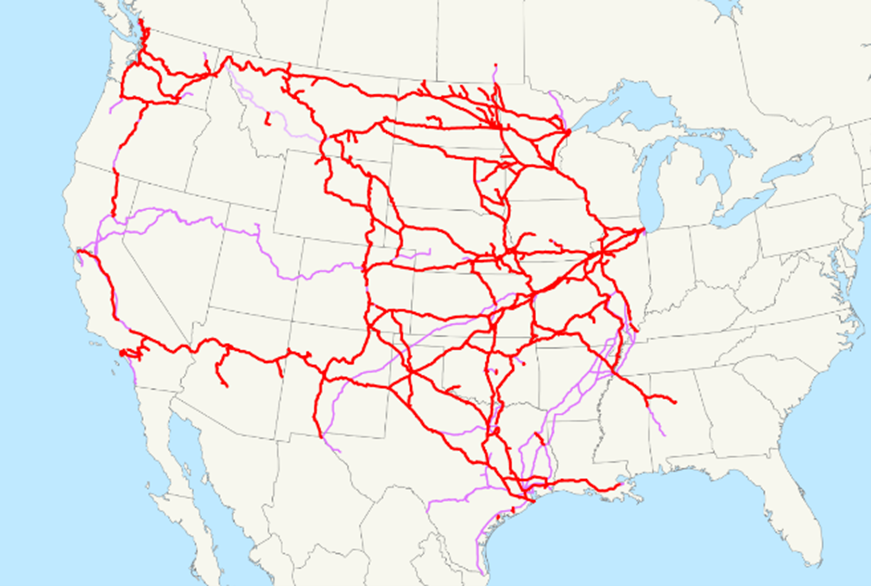

Burling Northern Santa Fe (BNSF)

BNSF operates over 32,500 route miles of track in 28 states. The North American rail industry has consolidated from 19 Class I railroads in the early 1980s to only 6 railroads, today. You couldn’t build another railroad with an unlimited budget. This business will exist for decades to come because railroads are the most efficient and low-cost method to transport heavy materials long distances. And, they keep a massive amount of freight off our roads and highways.

Freight volumes are steady, but they don’t grow. Profitability grows along with inflation because the railroads have tremendous pricing power to pass along higher operating costs. It earns an ROE of about 14-15% with modest leverage. Unlike trucking companies that use roads and highways paid for by government, railroads maintain their own track and infrastructure at their own expense. BNSF spends about $2 billion per year to maintain track and operations, but it can’t absorb growth capital expenditures and sends about $5 billion per year to headquarters for investment elsewhere.

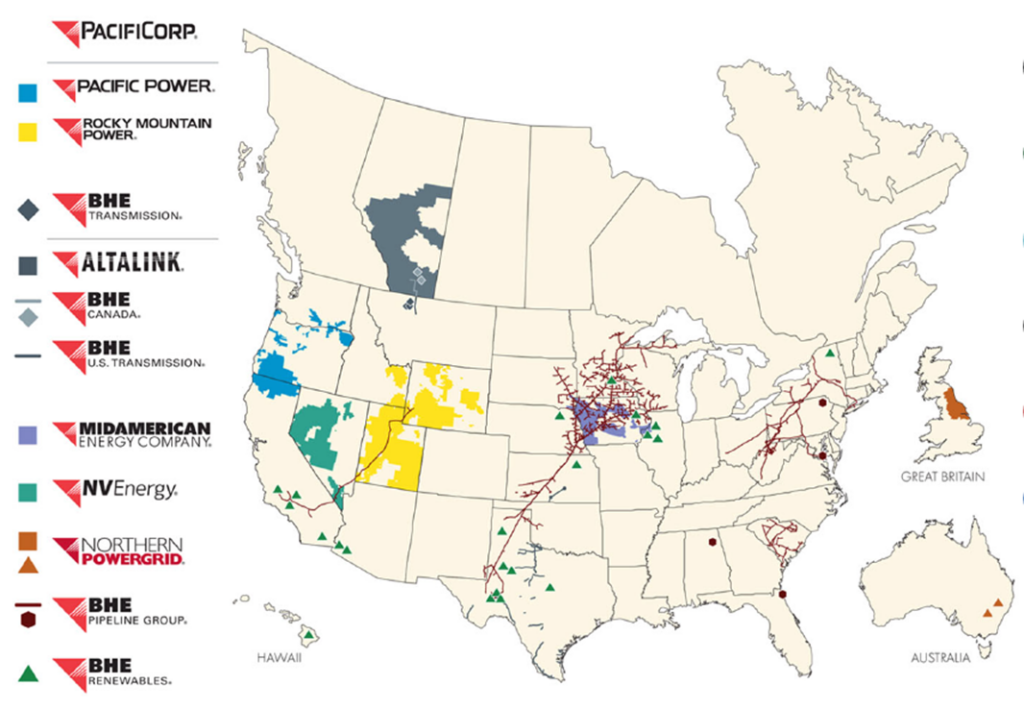

Berkshire Hathaway Energy (BRK owns 92%, Suzanne and Walter Scott Foundation own 8%)

BHE provides electricity and natural gas. It is the largest regulated renewable energy company (wind & solar) in the United States and is diversified by geography and asset type, including power generation from wind, solar, natural gas, and coal. It owns electricity transmission lines and natural gas pipelines that transport 15% of the natural gas consumed in the U.S. BHE served 9.2 million customers in 2022 and earned $4.3 billion after-tax.

Regulated utilities are a “put up more to make more business.” Because it’s inefficient for consumers to pay for two electric lines or two power generation plants when only one is required, the government allows a monopoly. In exchange for the local monopoly, regulators allow adequate returns on incremental capital for the business to be sustainable.

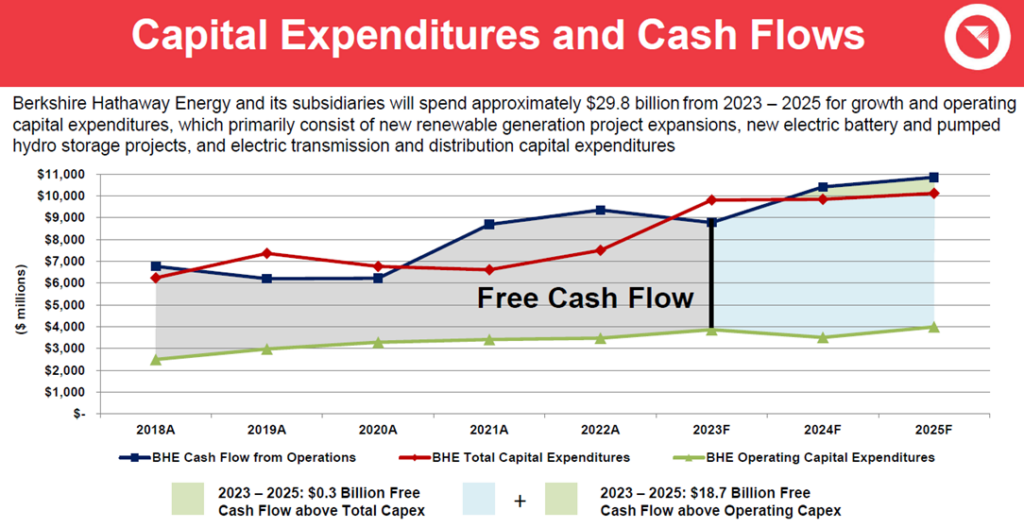

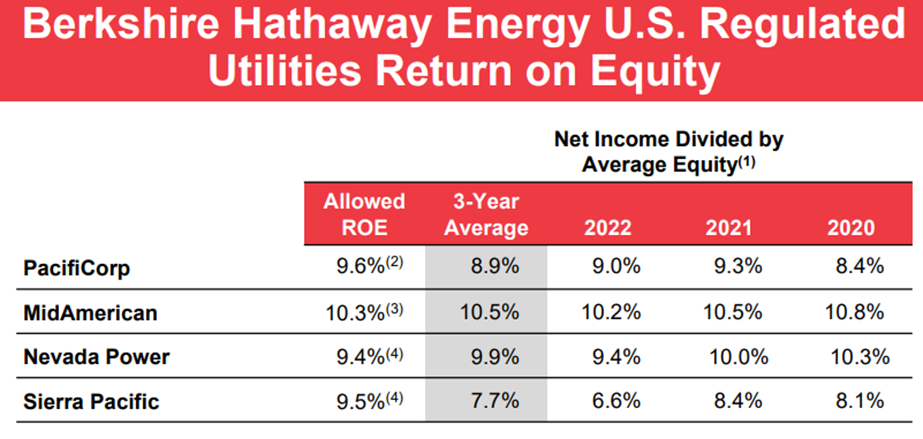

BHE has earned 9% on equity the past five years and I expect this rate to continue. See the “Allowed ROE” chart in the appendix. BHE reinvests all its profits to meet the growing and changing energy needs of the U.S. By 2025, BHE projects operating cash flow for BHE will grow to $11 billion from $9 billion last year and will earn $7 billion in free cash flow, all of which is projected to be reinvested in growth. The operating cash flow growth of 10% per year is no accident. It is a direct result of the increased capital invested.

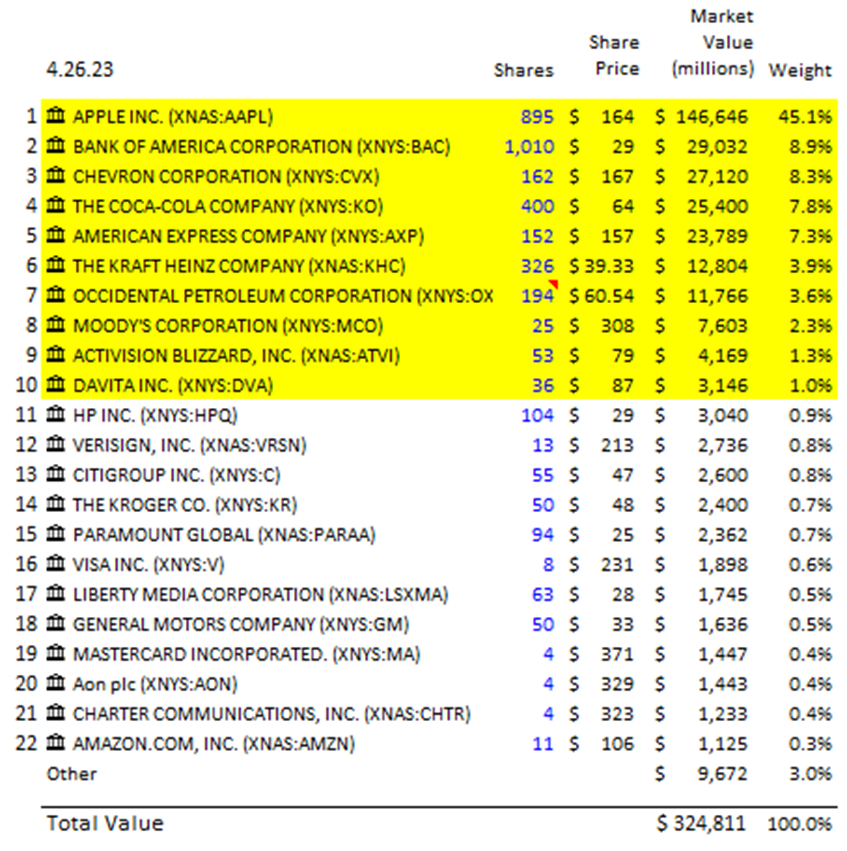

Publicly Traded Businesses

Buffett views stocks as interests in businesses and does not attempt to trade them based on short-term price expectations. He buys what he believes are high quality businesses with good prospects when shares are trading below a conservative estimate of fair value. He usually sells when business fundamentals deteriorate and rarely sells if prices become overvalued.

The publicly traded equity portfolio has become concentrated with a 45% position in Apple worth $146 billion. At the current price, Berkshire’s stake in Apple is now larger than the value of BNSF and BHE. Berkshire purchased the shares between 2016-2018 and have earned approximately 5x their money. To use the words Buffett borrowed from Peter Lynch, he “waters his flowers and cuts his weeds.” I would prefer they trim the position to reduce the exposure to China, but I wouldn’t be surprised if they hold it.

The top 10 positions in the portfolio account for 90% of the value. Buffett lets his winners run.

Management & Succession

Warren Buffett (92) and his partner Charlie Munger (99) are the geniuses behind the historical success of Berkshire Hathaway. Buffett is a savant with a near perfect memory and unmatched business acumen.

I would describe the culture as one of integrity. They take a win-win approach with all stakeholders involved in their wholly-owned businesses. Here are a few things Buffett has said in the past about culture.

- Send the bad news first; the good news can wait.

- If you wouldn’t want what you are contemplating doing reported on the front page of your local paper by an informed and critical reporter for all your friends and family to read, don’t do it.

- “Lose money for the firm and I will be understanding, lose a shred of reputation for the firm, and I will be ruthless.”

Buffett’s philosophy for operating companies has been to invest in the strength of the business for the long-term. He has a deep appreciation for the challenges businesses face to survive the creative destruction that comes with capitalism. The analogy he uses is to pretend the company is a castle and to build the moat around it as wide as possible. He recently spoke to this philosophy in an interview he gave on April 12th of this year.

“That doesn’t mean the world is coming to an end or anything because – 58 years I’ve been running Berkshire, I mean, we’ve run into all kinds of problems. But that’s what business is about. And we run our business so that we don’t depend on everything being hunky-dory always. We run it so that we will be the last man standing. And that’s the way, if millions of people are going to give me their money and tell me to take care of it, we’re going to try and take care of it. And if we don’t make as much money as we might’ve if we’d leveraged more or done other policies, so be it.”

At Buffett and Mungers’ age, what is important now for the success of Berkshire is the culture and succession plan they have structured. Buffett is still Chairman and CEO, but he has delegated the management of the operations and part of the investment portfolio.

In 2018, Greg Abel (60) was appointed to Vice-Chairman and head of the non-insurance businesses. He is a CPA by training and rose through the ranks of a Canadian energy company to become its CEO. Berkshire Hathaway acquired that company in 1999 and later renamed it Berkshire Hathaway Energy. He has deep experience with BHE, and for the past five years has made many improvements to the businesses in MSR. He has no plans to retire and recently bought $100 million of Berkshire Hathaway stock in the open market with proceeds from the sale of his 1% interest in BHE he sold to Berkshire Hathaway. His interests are now fully aligned with Berkshire shareholders, and he has significant skin in the game.

Ajit Jain (71) is Vice-Chairman and head of the Insurance business. Buffett has consistently praised Jain for providing tremendous value. In 2022, BRK purchased an insurance company called Alleghany that came with CEO Joe Brandon who was formerly the chairman of a BRK re-insurance subsidiary called General Re. I would be surprised if there was not a solid bench of capable managers willing and able to take over when Jain retires.

Buffett hired Todd Combs and Ted Weschler in 2011 and 2012 to help manage the investment portfolio. Buffett has carved out about $15 billion for each of them to manage with complete autonomy. It will be interesting to see how the portfolio and authority changes when Buffett steps back. He is not a believer in group decision making for investments.

The Benefits of Float

Berkshire Hathaway Insurance has $164 billion in float acting as 0% perpetual debt, so long as the float is stable and it breaks even on underwriting. The float has grown at a rate of 9% the past 20 years and 8.7% since 2014. It has earned in underwriting profit in 18 of the last 20 years and its combined ratio averaged 98.9% the past 10 years, meaning they earned 1.1% to hold the money. Berkshire’s 2022 annual letter stated, “With disciplined underwriting, these funds have a decent chance of being cost-free over time.” Borrowing at 0% and investing at positive returns enhances the returns to Berkshire shareholders.

If Berkshire can invest the float at 8% across its wholly-owned businesses and investment portfolio, the return to Berkshire shareholders would be 9.75%. The leverage is about 1.22x right now when applied against the equity value of its businesses. Here is the math: 8% return + 0.22 (8%-0%) = 9.76%. We don’t need false precision here. The point is that the 0% cost float enhances returns, whether the returns are 6%, 8%, or 10%. If you just look at the assets and say, “I think the assets will appreciate at 8% and therefore Berkshire stock will not increase faster than 8% over time,” you will probably underestimate the return of Berkshire stock.

Summary

Berkshire is attractively valued at about 13.4x average economic earnings of $53 billion or a 7.5% earnings yield before growth. To estimate current and future profits for Berkshire, I smooth out the price fluctuations of the investment portfolio by estimating an average after-tax return of 7% for equities and 3% for treasury-bills.

Berkshire doesn’t pay a dividend, nor dividend taxes. Instead, it reinvests profits organically, acquires businesses, or repurchases shares. Because all profits are retained, the return to shareholders will come from EPS growth and the change in the price relative to the earnings. In the short-term, the price multiple impacts the stock price more, but on a ten-year horizon and beyond, the EPS growth rate, driven by the return on reinvested profits, will be the dominant determinant of the shareholder return.

I think BRK will continue to reinvest profits at 8-9% as a base case. I assume BHE will earn 9%, MSR will earn 10%, and the investment portfolio will earn 7% after-tax. The investment portfolio has the widest distribution of potential returns, but I give them credit for a decent 7% return. Their investment returns in equities have historically been double digits, but its current scale of $325 billion reduces the opportunity set of investments large enough to make a difference. I think the huge weighting in Apple at 25x forward earnings with $400 billion in revenue and a single digit growth rate will make it even more difficult to earn double digit returns.

With the benefit of float, I think the 8-9% base case asset returns will lead to 9-11% returns to Berkshire Hathaway shareholders. I would be happy if Buffett took $40 billion of the cash on hand and the $30 billion in operating cash flow this year and repurchased 10% of shares outstanding.

Owning Berkshire Hathaway, one of the largest companies in America may be unoriginal, but it is not unsophisticated. I believe it will continue to survive, earn satisfactory returns, and beat most index funds, mutual funds, and hedge funds with higher costs, shareholder dilution, and shorter-term incentives.

Personal Note

I read my first Berkshire Hathaway annual report in 2008 when I took the “Investment Strategies of Warren Buffett” course at the University of Missouri under Professor Andrew Kern. We took a class trip to Omaha and visited him at his office. During the Q&A session, I asked him a question about the European put options he sold to insurance companies and was fortunate to ride shotgun in his Cadillac and sit next to him at lunch for an hour while we ate burgers and topped it off with ice cream sundaes. We talked about investments and the bank he had once owned in my hometown of Rockford, IL. I remember asking him, “how do you invest the other 1% of your portfolio not invested in Berkshire Hathaway stock” and he replied, “oh, I’ve got about $300 million in treasuries.” Nice!

My understanding and appreciation for the company he built has only grown over the years. He has built a ship to withstand hurricanes and keep moving forward.

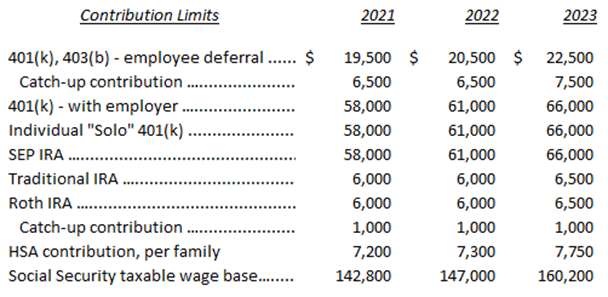

Planning

I included the updated 2023 IRS Indexed Limits in the 2022 letter, but here it is again for your reference. Please note, contributions into IRAs can be made in addition to 401(k)s. And, individuals with a side-hustle can contribute into a SEP IRA or Solo 401K in addition to their 401(K) from their employer. Finally, there is no income limit to make the Health Savings Account (HSA) contribution and receive the deduction. For those of you in the 42% combined state and federal tax bracket, a full family contribution will save you $3,062. Don’t pay more taxes than required!

Operations

Your portfolio analyst report for the first quarter is uploaded to the shared folder in your vault.

Thank you for placing me in a position of trust. It is an honor to work with you and manage your savings.

As always, please feel free to reach out anytime with your questions or comments.

With Thanks,

David Meehan, CFA

Founder & Chief Investment Officer

Appendix

Warranties & Disclaimers

There are no warranties implied. Maple Street Capital Advisors, LLC (“RIA Firm”) is a registered investment adviser located in Barrington, IL. Maple Street Capital Advisors may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.

This letter does not constitute, and should not be construed as, an offer of advisory services, securities or other financial instruments, a solicitation of an offer to buy any security or other financial instrument, or a recommendation to buy, hold or sell a security or other financial instruments in any jurisdiction. The provision of information in this letter does not constitute the rendering of investment, consulting, legal, accounting, tax or other advice.

The information presented in this letter reflects the author’s then-current views as of the date of the letter. As facts and circumstances change, the author’s views may change as well. This letter may include forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. In addition, new risks and uncertainties may arise from time to time. Accordingly, all forward-looking statements should be evaluated with an understanding of their inherent uncertainty. Maple Street Capital Advisors assumes no obligation to update this letter.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS, WHICH MAY VARY.

Certain information contained in this letter, such as economic and market information, is obtained from third-party sources and may not be updated through the date of the letter. While such sources are believed to be reliable, Maple Street Capital Advisors assumes no responsibility for the accuracy or completeness of such information.