2022 Client Letter

Dear Clients and Friends,

I hope you are doing well and looking forward to the new year.

Performance: Better Than Expected

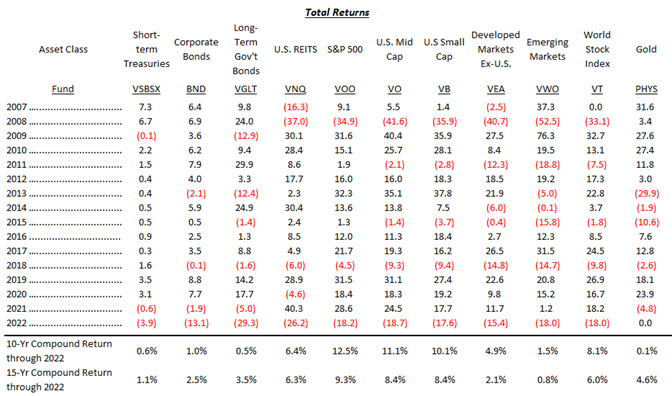

Frothy prices for most financial assets in 2021 dissolved in 2022. The S&P 500 (VOO) and international stocks (VEA) were down -18.2% and -15.4%, respectively. The corporate bond index (BND) was down -13.1%, its worst performance by over 10% going back to the index’s inception in 1976.

The “Outright Capital Appreciation”, “Capital Appreciation”, and “Moderate Capital Appreciation” portfolios averaged -7.8%, -1.8%, and -5.0%. I expect our relative returns to do well in a down year for the indexes and lag in an up year for the indexes, but I’m still pleased by the amount of our relative outperformance.

Your performance can be viewed at Interactive Brokers > Performance & Reports > PortfolioAnalyst as well as the annual performance report in your dashboard. The extent your returns are different from your elected model portfolio will largely be attributable to (1) weighting differences and (2) position differences, particularly if we elected not to sell securities with unrealized gains when you joined. I try to keep variances to a minimum, but there will always be variances because assets are not commingled, and we incorporate individual preferences and circumstances into portfolios.

Portfolio Attribution

Our returns above the indexes were largely attributable to our investments in the Vanguard Energy Fund (+62%), Black Stone Minerals (+80%), and Berkshire Hathaway (+3%). Allocations to gold (PHYS 0%), silver (PSLV 2%), and cash also helped our relative performance to our broad market index funds (VOO, VEA, VO, VB).

As you know, we complement broad market index funds with profitable and competitively advantaged businesses trading below a conservative estimate of fair value. Because of their price discount, profitability, and competitively advantaged positions, their stock prices tend to fluctuate less than the overall market. We benefited from this strategy in 2022. My primary goal for owning these businesses is to compound wealth over the long-term, but a secondary benefit is that they usually decline less in a down year.

New Holdings: KKR & Co and Apollo Global Management

We purchased KKR & Co (ticker: KKR) and Apollo Global Management (ticker: APO). Both are dominate, global, and growing asset management companies specializing in private equity and credit markets. As of September 30th, KKR and APO had $496 billion and $523 billion of assets under management, respectively. They have been following similar strategies of expanding from private equity to private credit, insurance (annuities), infrastructure, and real estate. They are highly profitable and benefit from global relationships and successful track records making them the low-risk choice for allocators of institutional capital. They have new initiatives to serve individual investors by offering less liquid, but higher yielding credit products.

In a world starved for yield and guarantees after market turmoil the past three years, I expect they will continue to raise large amounts of net new AUM from institutions and now individuals, globally. Both companies have a history of treating shareholders fairly, perhaps because employees of KKR and APO own 40% and 15% of their companies.

We purchased shares at low-teens earnings multiples giving us a margin of safety. Amazing given their size, but I think both companies have the potential to double their AUM and earnings per share over the next 4-5 years.

We Bought Bonds

We purchased bonds in the “Moderate Capital Appreciation” and “Capital Appreciation” portfolios with maturities longer than 1 year for the first time since Maple Street was founded in 2018. Previously, we have owned more cash and gold as an alternative to bonds, foregoing an incremental 1-2% of yield because the downside was 10-20% should rates rise just 2-3%. Unfortunately for bond investors, this event played out in 2022 as the Federal Reserve quickly increased the funds rate from ~0% in March to 4.25% by December and began reducing its balance sheet to bring down inflation. Long-term U.S. Government bonds declined -29%.

As a result of higher interest rates, short-term bonds have become more attractive, and we bought the Vanguard Short-Term Treasury fund (VGSH) and Vanguard Short-Term Bond fund (BSV). Both funds were yielding approximately ~4.4% at purchase. Treasury bonds usually benefit when markets are in distress because investors sell riskier investments and buy U.S. Treasury bonds for their safety and liquidity. The Fed may also lower interest rates during these periods, resulting in an appreciating asset we can sell to buy other assets at discounted prices. In the meantime, we receive a decent 4.4% yield.

Planning

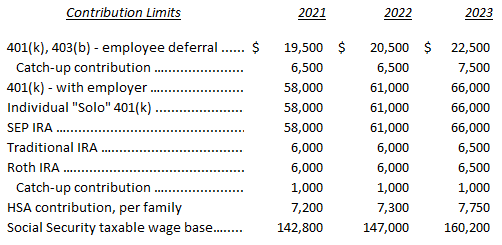

The chart below shows the new 2023 IRS Indexed Limits. Contributions for IRAs, SEP IRAs, and Health Savings Accounts can be made for tax year 2022 until April 18, 2023. Please note, contributions into IRAs can be made in addition to 401(k)s. Don’t pay more taxes than required!

Operations

We updated the Maple Street website with the help of Maria Lusardi at Industrial Marketers. Maria and I were in the same entrepreneurship academy at the University of Missouri in 2007-2008 where we visited business owners and ran a University-wide investment pitch competition. It’s been fun to work with her again. She’ll be doing SEO for Maple Street as I step up marketing efforts. If you know of anyone who might be a good fit for Maple Street, I would appreciate the introduction.

Thank you for placing me in a position of trust. It is an honor to work with you and manage your savings.

As always, please feel free to reach out anytime with your questions or comments.

With Thanks,

David Meehan, CFA

Founder & Chief Investment Officer

Warranties & Disclaimers

There are no warranties implied. Maple Street Capital Advisors, LLC (“RIA Firm”) is a registered investment adviser located in Barrington, IL. Maple Street Capital Advisors may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.

This letter does not constitute, and should not be construed as, an offer of advisory services, securities or other financial instruments, a solicitation of an offer to buy any security or other financial instrument, or a recommendation to buy, hold or sell a security or other financial instruments in any jurisdiction. The provision of information in this letter does not constitute the rendering of investment, consulting, legal, accounting, tax or other advice.

The information presented in this letter reflects the author’s then-current views as of the date of the letter. As facts and circumstances change, the author’s views may change as well. This letter may include forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. In addition, new risks and uncertainties may arise from time to time. Accordingly, all forward-looking statements should be evaluated with an understanding of their inherent uncertainty. Maple Street Capital Advisors assumes no obligation to update this letter.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS, WHICH MAY VARY.

Certain information contained in this letter, such as economic and market information, is obtained from third-party sources and may not be updated through the date of the letter. While such sources are believed to be reliable, Maple Street Capital Advisors assumes no responsibility for the accuracy or completeness of such information.