Client Update Spring 2021

Dear Clients and Friends,

I hope this letter finds you and your family healthy and doing well. As the uncertainty caused by the pandemic and other factors continues, I wanted to keep you updated on our latest thinking.

PLANNING

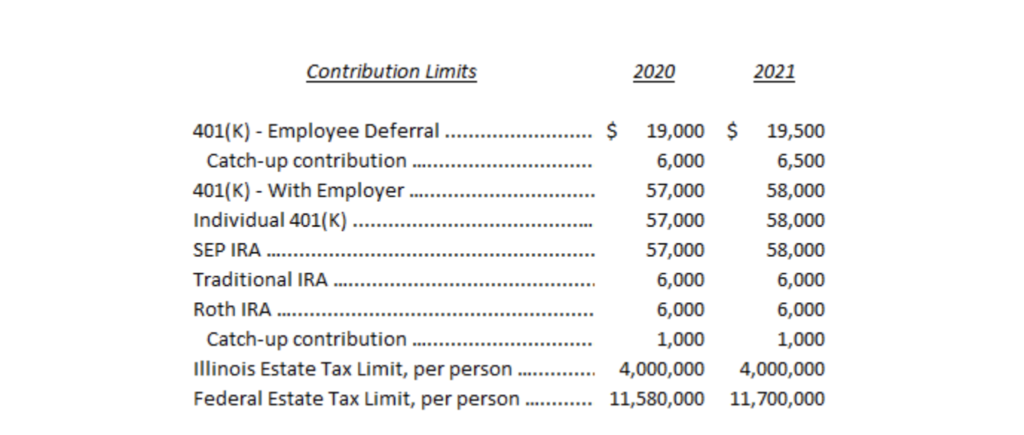

Below is a chart of the 2021 Indexed Limits as you consider your 2021 contributions. Contributions for 2020 can still be made into IRAs until May 17.

INVESTING

U.S., Europe, and Emerging Market stocks were up 6%1, 4%2, and 3%3 in the first quarter and have continued their ascent in April, up 11%, 8%, and 6% YTD.

Interest rates have modestly increased this year, causing bond prices to decline. Intermediate term corporate bond prices are down -2.5% 4 YTD and long-term U.S. Treasuries are down -10%5

LONG TERM BONDS? NOT AT THESE YIELDS!

A few clients have asked, “Why don’t we own long-term bonds in balanced accounts if they yield more than cash?” Well, the yield to maturity for the benchmark 8-year investment grade corporate bond index is only 1.33%. Longterm treasuries (24 years) yield ~2.2%. At these low yields, I think dollars invested in bonds today will purchase fewer goods and services over time as prices increase at a higher rate. Are your living expenses increasing less than 1.33% per year? Mine sure aren’t. Furthermore, the risk required to earn even 1.33% is not low. It requires taking on downside risk from higher interest rates, higher interest rate spreads, and defaults. In short, I prefer NOT to own any intermediate or long-term bonds with a potential upside of only 1%-2.5% through maturity.

For the bond allocation in balanced portfolios, I continue to stay very short by holding cash and short-term investment grade bonds and have increased weightings into alternative assets such as cumulative preferred shares, precious metals, REITS, and royalty companies. Additionally, we continue to have no exposure to “high yield” bonds because the yields are no longer high (<3.2%) especially relative to historical and potential losses.

EQUITIES

The Federal Reserve and U.S. Federal government continue to support the economy and financial markets at a staggering scale. It is estimated by the Chicago-based non-profit “Truth in Accounting” that the U.S. Federal government’s debt and unfunded liabilities (including Social Security & Medicare) increased ~$10 trillion in 2020. As a reference, the Federal Government’s revenue in 2019 and 2020 was $3.5 and $3.6 trillion. As such, it seems logical that future economic outcomes may be wider. For this reason, I have been focused on constructing resilient portfolios with high quality, real, durable, and diversified assets.

Outside of funds, our largest individuals security remains the equity of Berkshire Hathaway because I believe it has these characteristics and remains attractively valued.

In January, I added a precious metals asset manager called Sprott Inc. It manages closed-end trusts that own gold, silver, platinum and palladium. The current jewel of the business is the silver trust, ticker PSLV. It’s unique because the silver is held in the Canadian Mint and is “fully allocated,” meaning the trust owns specific bars of silver and no derivatives are sold against it, eliminating the risk the silver has been pledged more than once. Sprott Inc. can benefit from higher metal demand from investors or higher metal prices. Industry demand for silver in particular is increasing from growth in solar panels, electric vehicles, and electronics. Sprott Inc. gives us optionality to benefit from higher metal prices, but we don’t need higher prices to do well at the price we paid.

In March, I sold Texas Pacific Land Corporation, the owner of 880,000 acres in West Texas and significant mineral rights in the Permian Basin after the price blew through my fair value estimate. Cognizant that risk is a function of price, I chose to sell this great company when I could no longer justify the price without aggressive assumptions. Oil production companies such as Chevron pay TPL a percentage of the revenue generated from the oil and gas extracted. Incremental profit margins are very high because the producers take on the cost and risk of producing. We did very well owning TPL and hope to buy it again below fair value.

I have noticed that families are busier than ever. If you know of a family who could benefit from getting their financial house is in order, I would appreciate the introduction.

Thank you for placing me in a position of trust. As always, I love to hear from clients, so please feel free to call me anytime.

With Thanks,

David

.