Does an IRA Really Perform Better than a Brokerage Account?

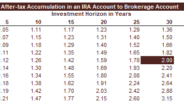

We all know an IRA account is better than a brokerage account over the long-term (10+ years), but how much better? I ran the numbers and here is the result: The same investments in an IRA or 401(k) account will result in twice as much after-tax money than a brokerage account in 30 years with a 7% average return. Both an IRA and 401(k) benefit from being “tax-deferred,” which means no taxes are due on an annual basis from interest, dividends, and capital gains. The money that would have been sent to the IRS can be reinvested and 100% of the profits from those reinvestments can also be reinvested.

If you are planning for a potentially 30-year retirement that doesn’t start for 10, 20, or 30 years, the difference between a retirement account and a brokerage account can be enormous. See Table 1 below that simply divides the retirement account in Table 2 by the brokerage account in Table 3. The benefit of tax-deferred accounts increases with return and time.

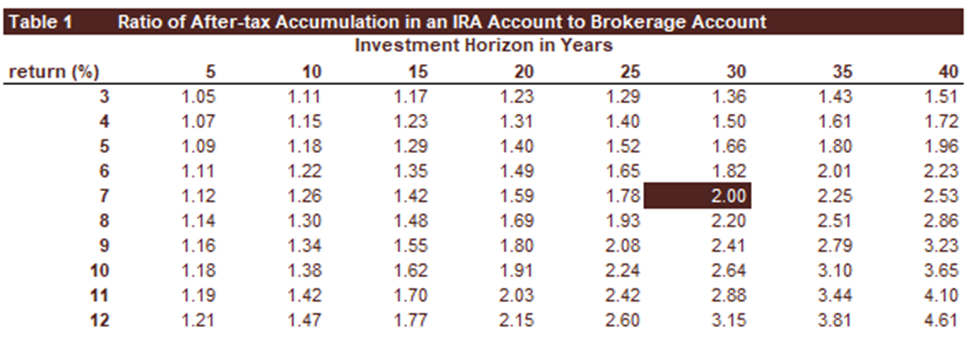

Table 2 is a compound interest table for an IRA. The after-tax result will be the same for a Roth IRA and Traditional IRA if the tax rates upon contribution and withdrawal are the same.

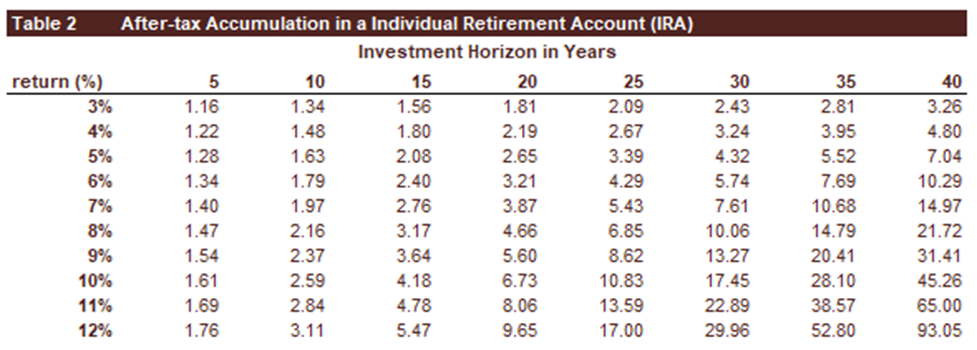

Table 3 is a compound interest table for a brokerage account.

Brokerage accounts do have their advantages. Notably, they have no contribution limits, and the money is accessible at any time with no age restrictions and accompanying early withdrawal penalties. That said, for money designated as “long-term money” for your retirement years, tax-deferred retirement accounts are the way to go!

Future Value of a Roth IRA: [Pre-tax Income X (1- income rate)] X [(1+0.07)^years]

Future Value of a Traditional IRA: Pre-tax Income X [(1+.07)^years] X (1- Income tax rate upon withdrawal)

[1] Future Value in a brokerage account = [Pre-tax Income X (1- income rate)] X [1+.07(1-blended tax rate)]^years

Interest payments from bonds are based on individual tax rates. Dividends from stocks are taxed at individual income tax rates until they are held for 61 days, after which they become “qualified dividends” and are taxed at capital gains tax rates. Capital gains tax rates range from 0% to 23.8% depending on individual income. The blended tax rate can vary significantly depending on portfolio turnover, holdings, and individual tax rates.