Retirement Planning

Let the certified retirement planners at Maple Street Advisors help you come up with the best retirement plan for your needs and goals.

The cost of funding a potentially 35+ year retirement is increasing. In addition to living longer, the cost of living, from housing, to healthcare, to food, is increasing every year and driving up the amount of wealth required to meet future needs.

Common questions we help clients answer while completing your financial planning for retirement, include:

- How much do I need to save to fund my retirement?

- How much wealth do I need to retire by a certain age?

- How much can I spend without running out of money?

- How should I invest to meet my future needs and goals?

- Am I on track to meet my goals?

What is Retirement Planning?

Retirement planning incorporates financial planning and investment management to efficiently build wealth and generate enough income to buy what you need during retirement. We believe saving and investing efficiently requires both knowledge and discipline.

- Savings: It starts with work and the discipline to underspend your income.

- Liquidity: Maintain adequate cash for emergencies and to promote long-term thinking by providing a level of safety.

- Tax Efficiency: Maximize retirement accounts to reduce taxes and build wealth faster.

- Investing: Invest for the long-haul with a disciplined and consistent process.

How can Maple Street help me reach my retirement goals?

We proactively recommend client’s maximize their eligible retirement account contributions and deductions, including Health Savings Accounts. If a client is approaching retirement, we will work with the client and recommend a withdrawal strategy. We also track financial metrics, including savings, net worth, and investment returns. This knowledge allows clients to improve financial decisions for their life.

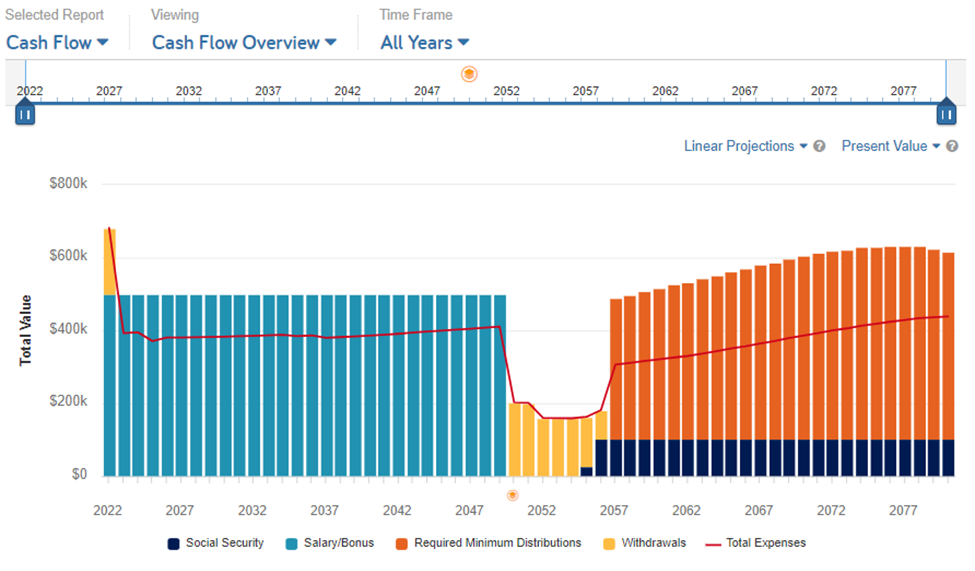

The chart below is a cash flow projection for a sample client. It shows where income will come from during retirement. In this example, required minimum distributions from pre-tax retirement accounts (orange) and social security (blue) exceed total living expenses (red line) throughout retirement. Because this sample client’s wealth is high relative to their income needs (low withdrawal rate), the portfolio is expected to continue to grow throughout retirement even with conservative return assumptions.

The chart above is for illustrative purposes and is not tied to an actual client.

Want to See if We Can Help?

Learn More About Maple Street

Investment Approach

Learn more about the investment principles that guide my approach and why I adhere to them.

Latest Insights

My regular updates with thoughts on the current financial climate and my current strategies.

About David

Learn more about my background, Maple Street and how we got here, and where we are going.