Making Side Income? Maximize Contributions with the Solo 401(K)

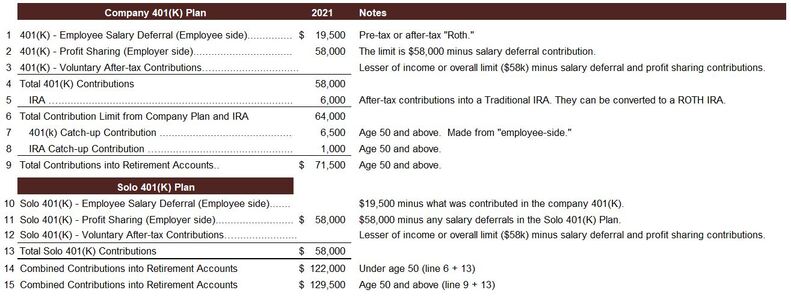

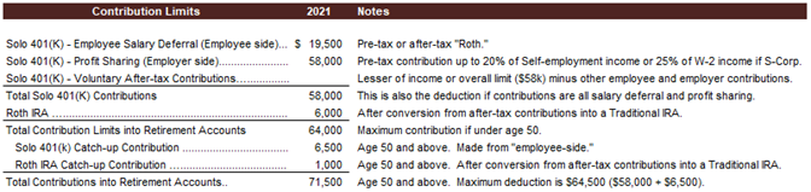

The Solo 401(K) is ideal for people who have self-employment income and would like to contribute more than 20% of their income. Unlike the SEP IRA, the Solo 401(k) allows “employee-side” contributions ($19,500) in addition to “employer-side contributions,” which are limited to 20% of net income. The overall limit is the same ($58,000), but if net income is less than $303,000, the Solo 401(K) will result in higher contributions and deductions.

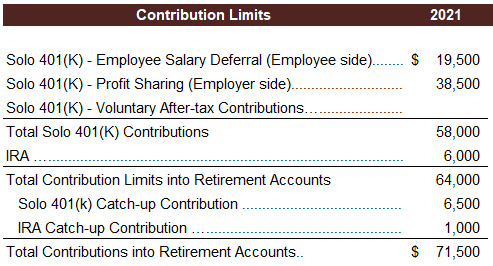

The overall limit for a Solo 401(k) can be met with net income of $204,000. In addition to the overall limit, an IRA contribution is also allowed, increasing the total contributions into tax-deferred accounts to $64,000 ($71,500 if age fifty and above). See details in the footnotes.

Investments within retirement accounts can lead to significantly greater wealth than if they had been made in a brokerage account because interest, dividends, and capital gains are not taxed annually. The money that would have been sent to the IRS can be fully reinvested with no taxes due until the money is withdrawn after age 59 ½. In addition, contributions are tax-deductible, reducing current year taxes (at high rates while working) and offer the potential for paying taxes at lower rates when taxable income is lower. To view the significant compound benefits of tax savings over time, see The IRA & 401(k) Advantage.

The Solo 401(k) for Your Side Business

The Solo 401(K) is especially beneficial for individuals with a 401(K) plan from their “full-time job” AND a side-business with self-employment income. In this situation, the individual can participate in BOTH plans and contribute up to $122,000 ($129,500 if age 50 and above) depending on the terms of the company plan and income from each source.

After-tax “Roth” Contributions

After-tax contributions should be considered if taxable income is expected to remain the same or increase, even in retirement. For individuals or couples filing jointly who expect their taxable income to decline in the future, especially in retirement before social security and required minimum distributions kick in (age 72), pre-tax accounts may be preferable. The percentage of an individual’s net worth in pre-tax and after-tax assets is another factor worth considering.

More Investment Options than the 401(K)

Solo 401(k) accounts have the same global access to investments as brokerage accounts. Company 401(k) plans usually limit investments to broad-based index and mutual funds, making it difficult or impossible to complement index funds with exchange traded funds and individual securities not included in the indexes or with an insignificant weight.

When should I set up a Solo 401(K) Account?

For sole proprietors to contribute for 2021, their Solo 401(k) Plan needs to be established by December 31st, but contributions do not need to be made until the tax filing deadline, including extensions. For individuals with S-Corporations, their Plan should be established as soon as possible because salary deferral contributions are required within 7 business days of payroll. Profit sharing contributions can be made until the tax filing deadline, including extensions.

How do I set up a Solo 401(K) Account with Maple Street Capital Advisors?

- Contact Maple Street to discuss your situation.

- Become a Maple Street client by signing the Investment Management Agreement.

- Maple Street will conduct a comprehensive analysis of your financial situation and work with you to develop a financial plan and investment strategy.

- Establish your Solo 401(k) Plan and open your investment account at Interactive Brokers, LLC.

- Maple Street will work you and your tax advisor(s) to determine the amount of your contributions and to file required tax forms.

- Fund your account.

Footnotes

IRC Sec. 402(g) is the salary deferral limit ($19,500 for 2021) and the limit applies once per taxpayer across all plans.The 415(c) overall limit is $58,000 and applies separately for each plan.There are limitations to accessing Solo 401(K)s, such as not having full time employees, being part of a controlled group or affiliated service group or having a 403B. Consult your tax advisor to learn more.